Getting The Pvm Accounting To Work

Getting The Pvm Accounting To Work

Blog Article

What Does Pvm Accounting Mean?

Table of ContentsWhat Does Pvm Accounting Mean?4 Easy Facts About Pvm Accounting ShownPvm Accounting - QuestionsThe Ultimate Guide To Pvm AccountingNot known Facts About Pvm AccountingSome Of Pvm AccountingAll About Pvm AccountingThe Greatest Guide To Pvm Accounting

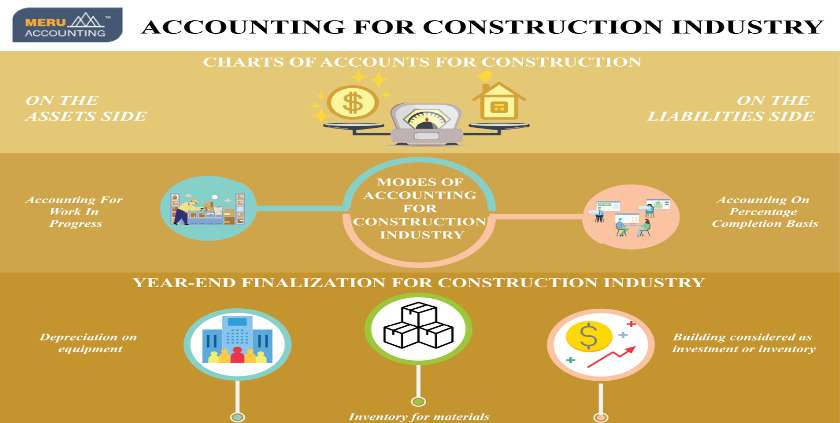

One of the primary reasons for executing accounting in building jobs is the requirement for monetary control and administration. Construction projects often require substantial financial investments in labor, products, devices, and other resources. Correct accounting enables stakeholders to check and handle these monetary sources successfully. Accountancy systems supply real-time insights right into job expenses, income, and earnings, enabling project managers to promptly determine possible issues and take restorative actions.

Construction tasks are subject to various monetary requireds and coverage requirements. Appropriate audit makes sure that all financial transactions are tape-recorded accurately and that the job abides with bookkeeping requirements and contractual agreements.

The 4-Minute Rule for Pvm Accounting

This lessens waste and improves job efficiency. To better comprehend the importance of accountancy in building, it's additionally vital to identify between building and construction management accounting and job administration bookkeeping.

It concentrates on the financial elements of individual building and construction projects, such as price estimation, price control, budgeting, and capital management for a specific project. Both kinds of accountancy are vital, and they match each other. Construction management accounting ensures the company's financial health, while project administration accountancy makes sure the financial success of individual projects.

Some Known Facts About Pvm Accounting.

An important thinker is needed, that will certainly collaborate with others to make decisions within their areas of responsibility and to surpass the locations' job procedures. The placement will certainly engage with state, university controller staff, school department staff, and academic scientists. He or she is anticipated to be self-directed once the initial understanding curve is gotten over.

The Main Principles Of Pvm Accounting

A Building and construction Accountant is in charge of taking care of the monetary facets of building and construction projects, consisting of budgeting, expense monitoring, economic reporting, and compliance with regulatory requirements. They work closely with task managers, specialists, and stakeholders to ensure precise economic records, expense controls, and prompt payments. Their experience in construction accounting principles, job setting you back, and financial analysis is essential for effective monetary administration within the building and construction industry.

The 6-Minute Rule for Pvm Accounting

As you've possibly learned by now, tax obligations are an inescapable component of doing company in the United States. While the majority of emphasis usually lies on government and state income taxes, there's additionally a 3rd aspectpayroll taxes. Payroll tax obligations are tax obligations on a worker's gross salary. The incomes from payroll taxes are utilized to fund public programs; because of this, the funds collected go directly to those programs rather than the Irs (INTERNAL REVENUE SERVICE).

Note that there is an extra 0.9% tax for high-income earnersmarried taxpayers who make over $250,000 or solitary taxpayers transforming $200,000. There is no employer suit for this added tax. Federal Joblessness Tax Obligation Act (FUTA). Earnings from this tax obligation go toward federal and state joblessness funds to help employees who have actually lost their tasks.

Pvm Accounting - An Overview

Your down payments must be made either on a regular monthly or semi-weekly schedulean political election you make before each calendar year. Month-to-month payments. A regular monthly settlement should be made by the 15th of the following month. Semi-weekly repayments. Every other week deposit dates rely on your pay timetable. If your payday falls on a Wednesday, Thursday or Friday, your deposit schedules Wednesday of the adhering to week.

Take treatment of your obligationsand your employeesby making full pay-roll tax obligation settlements on time. Collection and payment aren't your only tax obligations.

Getting The Pvm Accounting To Work

States have their own payroll tax obligations. Every state has its very own unemployment tax (called SUTA or UI). This tax price can differ not just by state however within each state also. This is due to the fact that your company's sector, years in service and unemployment background can all establish the portion used to compute the quantity due.

The 3-Minute Rule for Pvm Accounting

Lastly, the collection, compensation and reporting of state and local-level taxes rely on the governments that impose the tax obligations. Each entity has its very own rules click to investigate and approaches. Clearly, the subject of pay-roll tax obligations includes lots of relocating components and covers a variety of accountancy expertise. A U.S.-based global CPA can make use of expertise in all of these areas when recommending you on your special organization setup.

This site utilizes cookies to enhance your experience while you navigate through the site. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are vital for the working of fundamental capabilities of the internet site. We additionally make use of third-party cookies that aid us analyze and comprehend just how you utilize this website.

Report this page